Navigating Inflation: How Equities and Fixed Income Strategies Are Faring

Key Observations

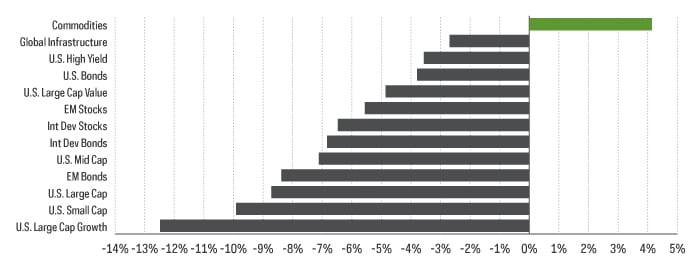

There was seemingly nowhere to hide in the month of April. It’s not surprising that stocks declined in the face of the ongoing war in Ukraine, but where was the flight-to-safety? The Bloomberg U.S. Treasury Index fell 2.8%, and the yield on the U.S. 10-Year Treasury rose roughly 60 basis points (bps) for the month. It’s clear that the combination of inflation and the Fed’s pending balance sheet reduction were powerful enough forces to overcome the typical instinct for a flight-to-safety during geopolitical distress.

A central question facing the equity markets is how well companies will be able to navigate an inflationary environment. Can companies raise prices sufficiently to grow their earnings? The historical long view is emphatically yes. Equities have delivered solid real returns over the decades and proven their worth as the key core portfolio holding. However, with about half of S&P 500 companies reporting Q1 earnings so far, this season’s results are prompting anxiety that likely contributed to April’s sell-off.

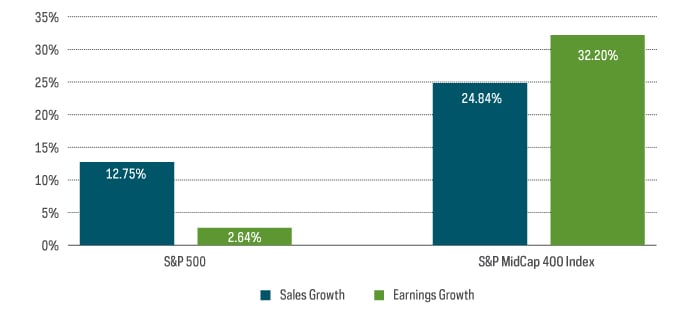

S&P 500 companies have delivered positive earnings growth so far this season, muting some concerns regarding stagflation or an earnings recession. Sales growth has come in roughly five-times greater than earnings growth, however, which has heightened concerns that inflation could drive margin compression.

There is a bright spot this season—mid caps. S&P MidCap 400 companies have not only delivered nearly twice the sales growth of large caps, but earnings growth has eclipsed sales growth, pointing to margin expansion. Years of mega-cap outperformance has left mid-caps out of many investor’s minds and portfolios… Consider this a timely reminder to consider returning them to both.

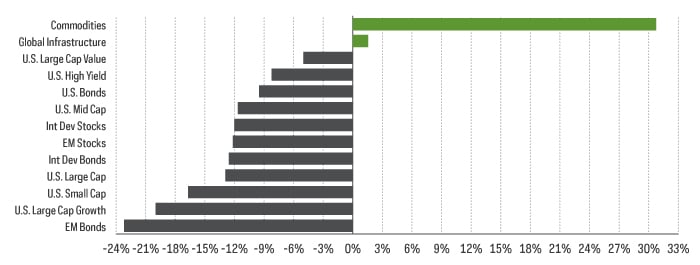

Asset Class Returns - YTD

Equity Perspectives

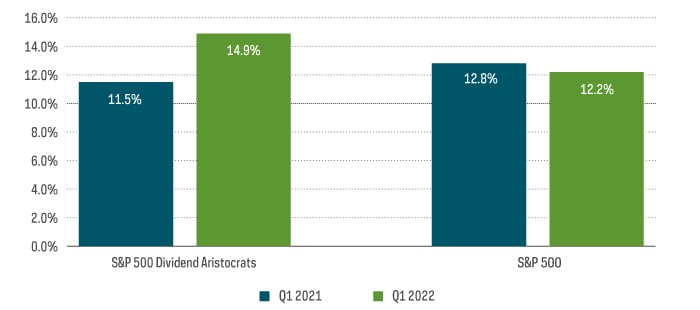

We are roughly half-way through a Q1 earnings season that could be critical to determining the market’s near-term market direction against a host of macro headwinds. As noted in the previous section, S&P 500 companies are thus far holding their own. They have posted an earnings growth rate of approximately 2.6% compared to the same period last year. Revenue growth rates have been even better, at 12.8%.

Beyond the headline sales and growth results, profit margins are likely to be a key metric that investors will watch closely. Surging commodity prices and snarled supply chains are pushing input costs higher for most product manufacturers. Service-based businesses aren’t getting off any easier, as ubiquitous “help wanted” signs and high rates of people quitting their jobs are pushing labor costs higher. Businesses are responding by raising prices, but how much can—or will—consumers tolerate?

The good news on the question above is that consumers are in relatively good financial shape and appear able to tolerate some measure of price increases. Unemployment remains low, households remain flush with cash, and consumer debt levels have been trending lower for years.

Businesses have a different set of concerns. In a period when input costs are going up across the board, sustainability of margins becomes a key question. While raising prices may be a natural reaction for some companies, not every company can do it. Even for those that are able, many may be unable to raise prices sufficiently to keep pace with their increasing input costs. Either way, it seems like margins will inevitably come under pressure. It's already happening in large caps. Roughly halfway through earnings season, FactSet has estimated that the net Q1 profit margin for S&P 500 companies is 12.2%, which is lower than Q1 2021 margins of 12.8% and Q4 2021’s margins of 12.4%.

On the other hand, companies with pricing power may be able to protect and perhaps expand their profit margins. How can investors identify such companies? One potential answer is the Dividend Aristocrats, a group of quality large- and mid-cap companies that have continuously raised their dividends over long periods of time. Dividend Aristocrats are commonly seen as having durable business models and long-term competitive advantages that have enabled them to raise their payouts over time. Features like scale, product distribution capabilities and being low-cost producers in their respective industries. In a period of rising prices and declining margins, Dividend Aristocrats can offer a potential alternative to broader-market companies not as well positioned for the environment.

Fixed Income Perspectives

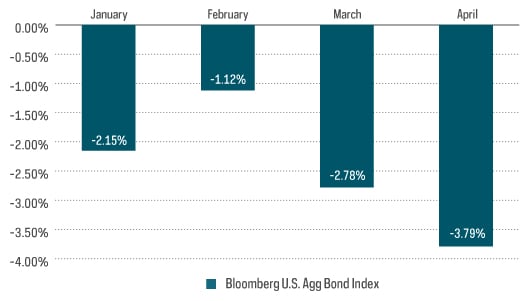

We noted in last month’s commentary that March was the toughest month for bonds so far this year. Continued headwinds in April have, unfortunately, given fixed income investors an even rougher ride. April marked the bond market’s worst performance in more than 42 years—it was the most severe one-month decline for the Bloomberg U.S. Aggregate Bond Index since February of 1980.

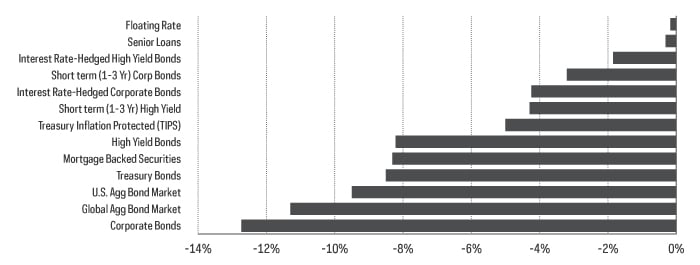

Corporate bonds have been the worst performing fixed income segment, year-to-date, in large part because of their sensitivity to interest rate movements. While a widening of credit spreads has served as an additional detractor, as of the end of April, the corporate bond market has the longest duration of all of the fixed income segments in the below chart. In fact, the most interest-rate-sensitive components of the fixed income market all fell towards the bottom of the pack. The exception was Treasury Inflation Protected Securities (TIPS), which have benefitted from an uptick in inflation expectations. TIPS have still fallen 5.00% this year and have a duration of 7.47 years.

While many investors have been enticed by the minimal interest rate sensitivity that floating rate bond strategies exhibit, they should consider the potential implications of those floating coupon payments. From an investor perspective, a debt instrument that pays out increasingly higher coupons as rates rise sounds almost idyllic. However, floating rate debt can burden companies—especially lower-rated companies—with greater than expected debt service payments. Those higher debt payments could mean greater credit risk for investors.

Floating rate strategies have outperformed most of the fixed income market so far this year, but it is important to remember not to place all of your eggs in one basket.

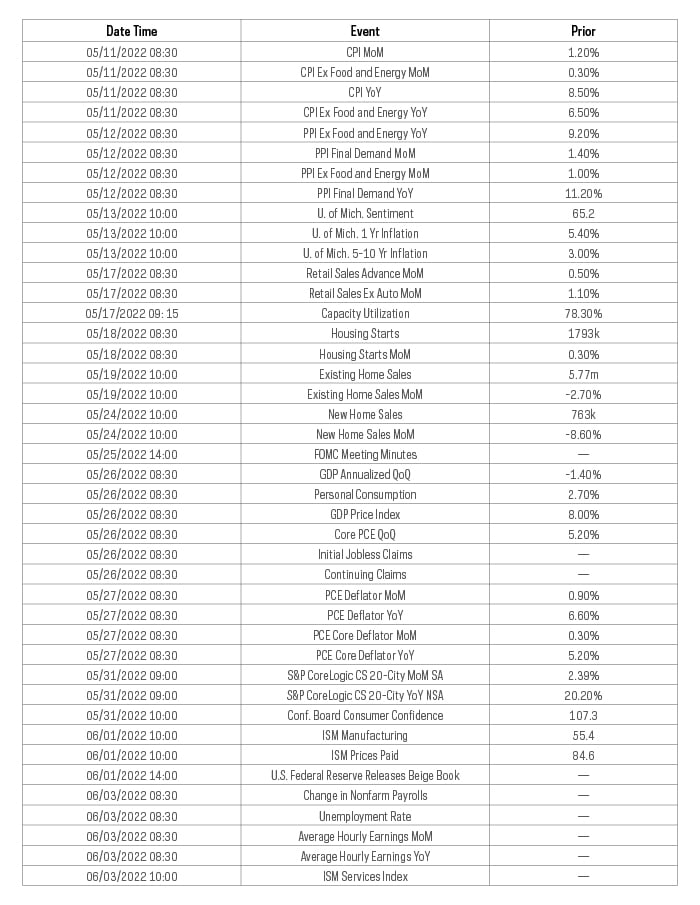

Short-duration strategies could be the right play, with minutes from the Fed’s March meeting indicating that the FOMC is likely to start shrinking its balance sheet quickly. This could put additional upward pressure on rates, with the Fed likely to hike its Federal Funds rate 50 more bps this month. You can learn more about fixed income strategies for this type of environment by reading our overview of rising rate strategies here.

Sources for data and statistics: Bloomberg, Morningstar, and ProShares.

The different market segments represented in the performance recap charts use the following indexes: U.S. Large Cap: S&P 500 TR; U.S. Large Cap Growth: S&P 500 Growth TR; U.S. Large Cap Value: S&P 500 Value TR; U.S. Mid Cap: S&P Mid Cap TR; U.S. Small Cap: Russell 2000 TR; International Developed Stocks: MSCI Daily TR NET EAFE; Emerging Markets Stocks: MSCI Daily TR Net Emerging Markets; Global Infrastructure: Dow Jones Brookfield Global Infrastructure Composite; Commodities: Bloomberg Commodity TR; U.S. Bonds: Bloomberg U.S. Aggregate; U.S. High Yield: Bloomberg Corporate High Yield; International Developed Bonds: Bloomberg Global Agg ex-USD; Emerging Market Bonds: DBIQ Emerging Markets USD Liquid Balanced.

THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

This is not intended to be investment advice. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results.

Any forward-looking statements herein are based on expectations of ProShare Advisors LLC at this time. Whether or not actual results and developments will conform to ProShare Advisors LLC’s expectations and predictions, however, is subject to a number of risks and uncertainties, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and other world economic and political developments. ProShare Advisors LLC undertakes no duty to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

Investing involves risk, including the possible loss of principal. This information is not meant to be investment advice.

Bonds will decrease in value as interest rates rise. International investments may also involve risks from geographic concentration, differences in valuation and valuation times, unfavorable fluctuations in currency, differences in generally accepted accounting principles, and economic or political instability. In emerging markets, many risks are heightened, and lower trading volumes may occur. Small- and mid-cap companies may lack the financial and personnel resources to handle economic or industry-wide setbacks, and, as a result, such setbacks could have a greater effect on small- and mid-cap security prices.

The “S&P 500® Dividend Aristocrats® Index” and "Dow Jones Brookfield Global Infrastructure Composite Index” are products of S&P Dow Jones Indices LLC and its affiliates and have been licensed for use by ProShares. “S&P®” is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”), and “Dow Jones®” is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and they have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. ProShares based on S&P indexes are not sponsored, endorsed, sold or promoted by S&P or their affiliates, and make no representation regarding the advisability of investing in ProShares. THIS ENTITY AND ITS AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.