The nature of infrastructure is changing, and that may impact how investors seek to benefit from the market segment. Traditionally, there have been two primary justifications for investing in infrastructure.

First, the market segment was perceived as a stable, slow-growth, yield-oriented investment. Second, some see infrastructure as an investment with the potential to help them manage economic downturns, in particular because a government stimulus during a recession can potentially produce an early-cycle benefit.

While both of these justifications remain true today, the future of infrastructure may be much more dynamic. The combination of demographic pressures, new technologies and changing consumer behavior could trigger meaningful long-term changes in infrastructure from which investors could benefit.

Demographic Pressures

United Nations demographic research suggests that global population could grow from 7.8 billion in 2020 to 9.2 billion in 2040.1 The G-20 infrastructure project estimates that, in order to keep pace with expected global population growth over the next 20 years, infrastructure spending should be $3 trillion to $4 trillion every year—we are underinvesting by 19% instead.2

New Technologies

New technologies are playing a critical role in changing the infrastructure segment. Traditional infrastructure assets like roads, bridges and ports still play a critical role. However, the recent infrastructure spending bill designed by the White House also included areas such as communication infrastructure, water security and electric vehicles, as well as resilience in areas like the power grid. The infrastructure we need globally, and that will power the next century, will almost certainly be much more dynamic than in the past.

Consumer Behavior

Shifting patterns in consumer behavior are also likely to play a critical role in the future development of infrastructure. The growing importance for people to be in constant communication means we need increasingly effective ways to be online. The growth of e-commerce means increasing transportation needs for shipping, which requires high-quality roads, bridges, rails and ports.3 The shift to electric vehicles could potentially reverse a decade-long decrease in U.S. electrical output, as people shift from gasoline to electricity that will be increasingly powered by sources like natural gas, wind, solar and hydrogen. Investors seem to be warming to these shifts, and the ProShares DJ Brookfield Global Infrastructure Fund (TOLZ) had gained 14% year to date as of August 30, 2021. The charts in the three sections that follow highlight how coming changes could actually impact infrastructure now—and the scale of investment required to meet future needs. While the transformation of infrastructure is still in early stages, investors may want to consider getting into this increasingly dynamic segment early.

1. Communication Infrastructure

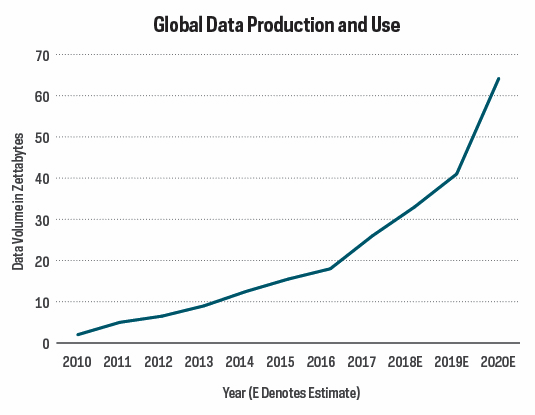

Access to high-quality communication networks is increasingly important today, and that need was accelerated by the record number of people who began working remotely during the pandemic. Proverbial “big data” is also getting larger every day. Storable data was estimated to reach 64 zettabytes in 2020, and that figure is expected to grow at an annual rate of 23% through 2022. Even more amazing is that half of all the storable data in the world today was produced in just the past three years.4 To support this rapidly growing stream of data, existing networks will need more capacity (wider bandwidth). In total, capital expenditures at leading wireless providers American Tower, Crown Castle and SBA Communications grew by 8.5% on an annualized basis from 2017 to 2020, compared to just 1.6% for the S&P 500, reflecting the importance of building capacity to meet demand in communications and data transfer.5 The Biden administration’s infrastructure proposal called for $65 billion allocated for communication.6 With more investment to build capacity, communication infrastructure owners and operators should be able to service more customers.

Source: IDC, Statista, June 2021

2. Electric Vehicles and the Power Grid

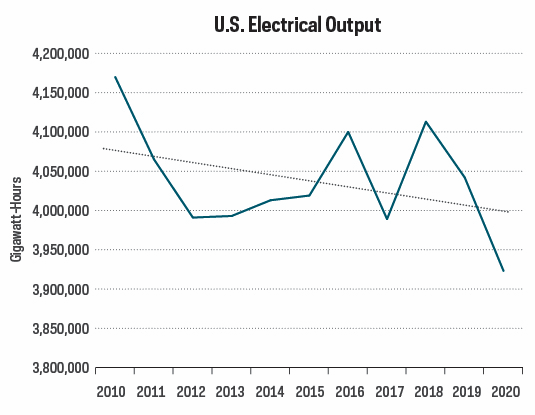

Electric vehicles represented about 1.8 million of the 287 million cars on the road in the United States in 2020.7 What many do not realize, though, is that EVs were reasonably popular early in automotive history, accounting for about one-third of U.S. vehicles in 1900.8 Ultimately, however, the internal combustion engine and relatively low cost of gasoline, a chemical byproduct of producing the kerosene used to power houses and cities at the time, won out. With recent technological advances and concern for the environment, electric vehicles have become popular once again. The Biden administration has made EVs a critical part of the green energy plan and proposed $174 billion to help develop the associated infrastructure.9 That said, current energy and utility firms may already be well positioned for the widespread adoption of electric vehicles. The United States has steadily decreased electricity use over the last decade, and sales per share of utility companies were down 20% from 2010 to 2020.10 Significant investment to electrify the drivetrain, increased use of EVs and adding charging stations to support them could wind up reversing this decade-long trend, as electricity demand could increase in response.

Source: Projections based on data from: Edison Electric Institute, May 2021; Edmunds, September 2020; U.S. Energy Information Administration, February 2021; U.S. Department of Transportation and Federal Highway Administration, November 2020; AAA American Driving Study, 2015.

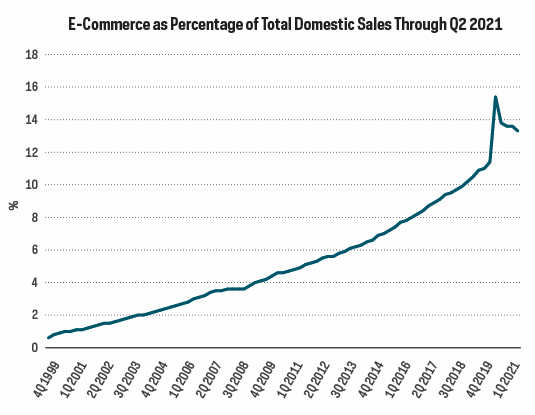

Roads and Bridges with Rise of E-commerce

The American Society of Civil Engineers grades U.S. roads and bridges as “D” and “C,” respectively, and believes we are badly in need of greater investment in infrastructure.11 While roads and bridges might not seem like a high-tech opportunity, these transportation resources are critical to shipping and the associated growth of e-commerce, which still only accounted for 13.3% of total U.S. retail sales as of the second quarter.12 One of the reasons that e-commerce has outshined the brick-and-mortar retail industry is tied to improvements in delivery speed. Amazon changed the game with free two-day shipping for Prime members, and the retail and shipping industries are still adapting to keep up. Last-mile delivery (delivery from a shipment hub to the final destination) remains one of the biggest challenges, and good roads are critical to that execution.

That said, modern supply chains use the full range of shipping resources, including ports, airports, logistical facilities and rails. There are already worldwide delays in freight. Continued growth of e-commerce could strain all of these existing resources more than they are already, further exacerbating their need to be enhanced and augmented. E-commerce growth has already driven delivery prices higher too, as FedEx local contractors have been paying 50% more for the rights to handle packages within designated routes over the past three years.13 While customers are paying lower costs for delivery, the quality of infrastructure will play an important part in e-commerce growth and the on-demand economy throughout the supply chain.

Source: U.S. Census Bureau, August 2021

Once a lucrative but seemingly sleepy investment, infrastructure growth could well become supercharged by the innovation going on around us. The industries of the future will need energy, communications and means of product movement to thrive. Infrastructure owners and operators will play a key role in facilitating those businesses.

Invest in Infrastructure: The Infrastructure Investment Opportunity

For investors, these tides of change in infrastructure represent a potential investment opportunity.

With long-term government and industrial commitments to energy transformation around the world, maintaining and enhancing current energy infrastructure, and developing new infrastructure, should be critical for decades to come. As a result, the owners and operators of those pipelines, energy grids, roads, freight yards, ports and other infrastructure may be poised for growth.

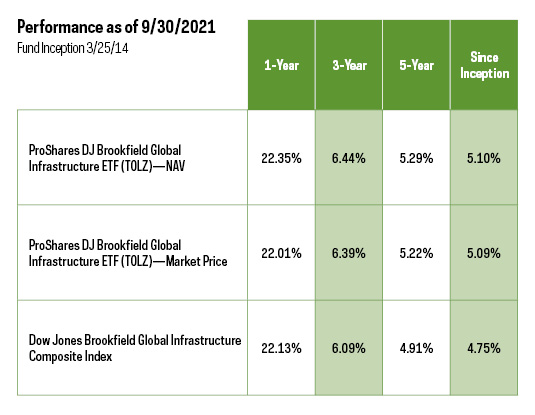

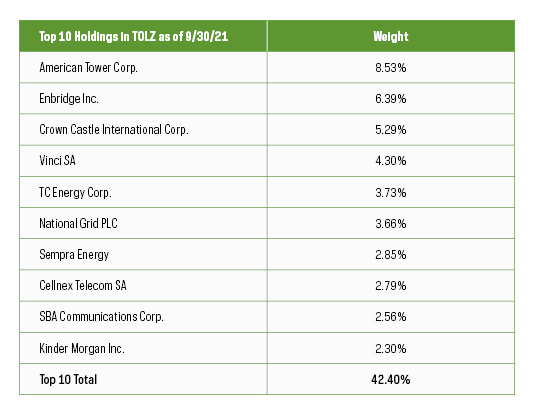

To take advantage of this investment opportunity, we invite you to explore the ProShares DJ Brookfield Global Infrastructure ETF (TOLZ). TOLZ invests in the “pure-play” owners and operators of transportation, communication, water and energy infrastructure. Pure-play refers to companies that derive 70% or more of their cash flow from infrastructure lines of business, as tracked by the Dow Jones Brookfield Global Infrastructure Composite Index. The TOLZ portfolio’s energy infrastructure exposure includes midstream-energy pipelines as well as electricity transmission and distribution systems that may be well positioned for the world’s transformation to a cleaner energy future. This segment made up 14.55% of the fund as of 6/30/2021.

1 UN, DESA, Population Dynamics. World Population Prospects 2019. http://population.un.org/wpp/

2 https://outlook.gihub.org/

3 https://hbr.org/2016/04/why-the-future-of-e-commerce-depends-on-better-roads

4 Statista, June 2021.

5 Bloomberg.

6 https://www.nytimes.com/2021/08/02/us/broadband-infrastructure.html

7 https://www.pewresearch.org/fact-tank/2021/06/07/todays-electric-vehicle-market-slow-growth-in-u-s-faster-in-china-europe/

8 Ibid.

9 https://techcrunch.com/2021/03/31/biden-infrastructure-plan-proposes-spending-174b-to-boost-americas-ev-market/

10 Bloomberg.

11 ACSE; https://infrastructurereportcard.org/wp-content/uploads/2020/12/2021-Grades-Chart.jpg

12 https://www.census.gov/retail/mrts/www/data/pdf/ec_current.pdf

13 Bloomberg.

Important Information

As of September 30, 2021 TOLZ’s total operating expenses are 0.47%.

This information is not meant to be investment advice. There is no guarantee forecasts will be met. Index performance is for illustrative purposes only and does not represent fund performance. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest in an index.

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Shares are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Market price returns are based upon the midpoint of the bid/ask spread at 4:00 p.m. ET (when NAV is normally determined for most funds) and do not represent the returns you would receive if you traded shares at other times. Brokerage commissions will reduce returns. Current performance may be lower or higher than the performance quoted. For standardized returns and performance data current to the most recent month end, see Performance.

Investing is currently subject to additional risks and uncertainties related to COVID-19, including general economic, market and business conditions; changes in laws or regulations or other actions made by governmental authorities or regulatory bodies; and world economic and political developments.

Investing involves risk, including the possible loss of principal. This ProShares ETF is diversified and entails certain risks, including imperfect benchmark correlation and market price variance, that may decrease performance. Please see summary and full prospectuses for a more complete description of risks. There is no guarantee any ProShares ETF will achieve its investment objective.

This ETF is subject to risks faced by companies in the infrastructure, energy and utilities industries to the same extent as the Dow Jones Brookfield Global Infrastructure Composite Index is so concentrated. This ETF invests in master limited partnerships (MLPs). Investments in MLPs expose the ETF to certain tax risks associated with investing in partnerships. Changes in U.S. tax laws could revoke the pass-through attributes that provide the tax efficiencies that make MLPs attractive investment structures. MLPs may also have limited financial resources, may be relatively illiquid, and may be subject to more erratic price movements because of the underlying assets they hold. In addition, a portion of the ETF's distributions may be a return of capital, which constitutes the return of a portion of a shareholder's original investment. Under tax rules, returns of capital are generally not currently taxable, but lower a shareholder's tax basis in their shares. Such a reduction in tax basis will result in larger taxable gains and/or lower tax losses on a subsequent sale of shares.

International investments may involve risks from: geographic concentration, differences in valuation and valuation times, unfavorable fluctuations in currency, differences in generally accepted accounting principles, and from economic or political instability.

Emerging markets are riskier than more developed markets because they may develop unevenly or may never fully develop. Investments in emerging markets are considered speculative.

Carefully consider the investment objectives, risks, charges and expenses of ProShares before investing. This and other information can be found in their summary and full prospectuses. Read them carefully before investing.

The “Dow Jones Brookfield Global Infrastructure Composite” Index is a product of S&P Dow Jones Indices LLC and its affiliates and has been licensed for use by ProShares. “S&P®” is a registered trademark of Standard & Poor’s Financial Services LLC (“S&P”) and “Dow Jones®” is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”) and have been licensed for use by S&P Dow Jones Indices LLC and its affiliates. ProShares have not been passed on by S&P Dow Jones Indices LLC and its affiliates as to their legality or suitability. ProShares based on the Dow Jones Brookfield Global Infrastructure Composite Index are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P or their respective affiliates, and they make no representation regarding the advisability of investing in ProShares. THESE ENTITIES AND THEIR AFFILIATES MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO PROSHARES.

Learn More

TOLZ

DJ Brookfield Global Infrastructure ETF

TOLZ focuses exclusively on pure-play companies—the owners and operators of infrastructure assets such as toll roads, airports and cell towers.